Medicare Advantage Made Simple

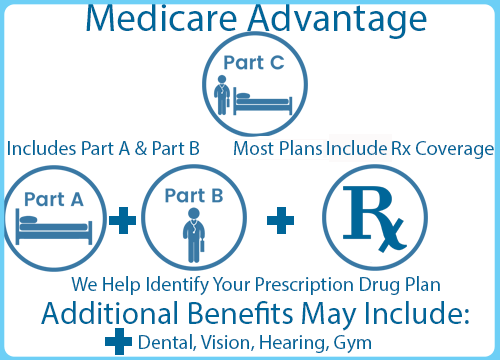

While the majority of people with Medicare get their health coverage from Original Medicare, some choose to get their benefits from a Medicare Advantage Plan, also known as a Medicare private health plan or Part C. MA Plans contract with the federal government and are paid a fixed amount per person to provide Medicare benefits.

The most common types of MA Plan are:

- Health Maintenance Organizations (HMOs)

- Preferred Provider Organizations (PPOs)

- Private Fee-For-Service (PFFS)

You may also see:

- Special Needs Plans (SNPs)

- Provider Sponsored Organizations (PSOs)

- Medical Savings Accounts (MSAs)

Remember, you still have Medicare if you enroll in an MA Plan. This means that you likely pay a monthly premium for Part B (and a Part A premium, if you have one). If you are enrolled in an MA Plan, you should receive the same benefits offered by Original Medicare. Keep in mind that your MA Plan may apply different rules, costs, and restrictions, which can affect how and when you receive care. They may also offer certain benefits that Medicare does not cover, such as dental and vision care.

All Medicare Advantage Plans must include a limit on your out-of-pocket expenses for Part A and B services. For example, the maximum out-of-pocket cost for HMO plans in 2018 is $6,700. These limits tend to be high. In addition, while plans cannot charge higher copayments or coinsurances than Original Medicare for certain services, like chemotherapy and dialysis, they can charge higher cost-sharing for other services.

Remember: MA Plans may have different:

- Networks of providers

- Coverage rules

- Premiums (in addition to the Part B premium)

- Cost-sharing for covered services

Even plans of the same type offered by different companies may have different rules, so you should always check with a plan directly to find out how its coverage works.

Many Medicare Advantage Plans also offer prescription drug coverage (Part D). If you join an MSA plan or a PFFS plan without drug coverage, you can enroll in a stand-alone Part D plan. Remember that people with Original Medicare who want Part D coverage also enroll in a stand-alone Part D plan.

If you have health coverage from your union or employer (current or former) when you become eligible for Medicare, you may automatically be enrolled in an MA Plan that they sponsor. You have the choice to stay with this plan, switch to Original Medicare, or enroll in a different MA Plan. Be aware that if you switch to Original Medicare or enroll in a different MA Plan, your employer or union could terminate or reduce your health benefits, the health benefits of your dependents, and any other benefits you get from your company. Talk to your employer/union and your plan before making changes to find out how your health benefits and other benefits may be affected.

Who can join an Medicare Advantage plan?

You can join an MA Plan if: